Cash App, the money management platform that needs no introduction!

When you need to instantly send money to someone without the hassle of banks or waiting times, Cash App is there for you. I still remember the first time I used it to split a dinner bill with a friend, and that’s when I discovered this amazing app.

In just seconds, the money was transferred. It felt like magic, but it was simply technology done right. If you’ve been curious about what Cash App is, how it works, and how to use it, then you’ve come to the right place.

I’ve explained everything in this guide in a simple and practical way for everyday life.

Cash App is a mobile payment service that allows you to send and receive money quickly using your smartphone.

Developed by Block, Inc. (formerly known as Square), it has gained immense popularity in the US and UK for personal and some small business transactions, all done directly from smartphones.

What bank does Cash App use?

Cash App has outsourced all its financial activities to two FDIC-insured banks, which are Sutton Bank and Lincoln Savings Bank.

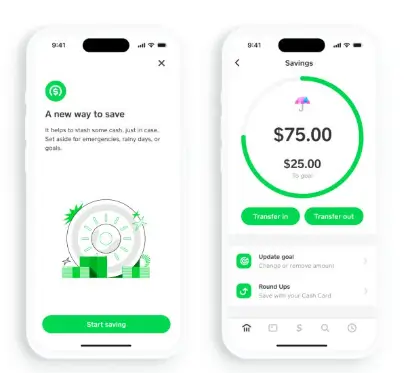

What sets Cash App apart is its simplicity and flexibility. You can pay friends, shop online, invest in stocks, buy Bitcoin, and even get a debit card, all within the same app. It’s like having a mini bank in your pocket, and the best part is that it’s free to use for most features.

Before delving into the functionality, let me highlight some standout features that make Cash App more than just a peer-to-peer payment tool.

1. Send and Receive Money Instantly

This is the core of what Cash App does. You can send or request money from anyone using their $Cashtag, phone number, or email address. Transfers are usually instant, making it perfect for splitting bills, paying rent, or sending birthday gifts.

2. Get a Free Cash App Card

Cash App offers a free customizable Visa debit card called the Cash Card. You can use it for online and in-store purchases, and it connects directly to your Cash App balance. It can also be linked to Apple Pay or Google Pay for added convenience.

3. Direct Deposit and ACH Transfers

You can receive your salary or government benefits using Cash App for direct deposit. The app provides you with an account and routing number so you can get paid just like you would with a traditional bank.

4. Buy, Sell, and Hold Bitcoin

Yes, Cash App allows you to buy Bitcoin directly from your balance. It’s a simple, beginner-friendly way to enter the world of cryptocurrency without signing up for a separate exchange. This gives you a hands-on experience of crypto with the help of the Cash App.

5. Invest in Stocks

Cash App Investing enables you to buy and sell stocks with as little as $1. There are no commission fees, making it a great starting point for beginners interested in investing. Simply install the app on your iOS, Android, or Google Pixel smartphone and start using it.

6. Boost Rewards

This feature provides you with instant cashback discounts at select merchants when using your Cash Card. I’ve personally used Boosts to get discounts at coffee shops, grocery stores, and fast-food places. It’s like having built-in coupons.

7. Safety and Privacy

Cash App uses encryption and fraud detection technology to keep your data secure. You can even block and unblock individuals on Cash App to manage your interactions. Additionally, the developer company understands cybersecurity risks and has implemented additional security features like Face ID, Touch ID, or a passcode to protect your funds.

Cash App acts as a digital wallet connected to your debit card, bank account, or your app balance. While it doesn’t require a bank account to function, connecting one offers more flexibility.

When someone sends you money, it appears in your Cash App balance. You can keep it there, spend it with your Cash App Card, withdraw it to your bank, or use it to invest. Everything is done in real-time with just a few taps.

- Download Cash App from the App Store or Google Play.

- Enter your phone number or email.

- Verify your identity using the code sent to you.

- Add a debit card to Cash App to receive and withdraw money.

- Tap the Dollar sign on the home screen.

- Enter the amount.

- Tap Pay or Request.

- Enter the recipient’s $Cashtag, email, or phone number.

- Add a note if desired, then confirm.

How to Use the Cash App Card?

- Order your Cash App card for free.

- Activate it through the app.

- Start spending your Cash App balance anywhere Visa is accepted.

- Use Boosts to get discounts on purchases.

How to Deposit or Withdraw Funds from Cash App?

You can easily add cash to Cash App by linking a debit card or bank account. Additionally, you can set up direct deposit for your paycheck. When it comes to withdrawing money from Cash App, you can do so using the Cash App card.

Simply visit in-network ATMs if you’ve received a direct deposit of $300 or more to avoid any fees.

One of the first questions people often ask is about safety when it comes to money. And that’s completely understandable. When money is involved, safety is crucial.

Cash App employs advanced security features like data encryption and fraud protection to ensure the privacy of your transactions. You can also enable additional protections like passcodes or biometric login. However, it’s important to note that while Cash App offers banking features through partner banks, it doesn’t provide the same regulatory protections as FDIC-insured institutions for all services. If you prefer a more secure platform, you can delete your Cash App account and explore other alternatives.

My advice? Use it wisely. Avoid sending money to unknown individuals, and always double-check recipient details before making a transaction.

Pros and Cons of Using Cash App

| Pros | Cons |

|---|---|

| Instant transfers | Limited international support (only US and UK) |

| No fees for standard banking features | Customer service can be slow |

| Easy to use interface | Not FDIC-insured unless using direct deposit |

| Includes investing and crypto features | |

| Free debit card with rewards |

How Cash App Compares to Other Payment Apps?

You may be wondering how Cash App stacks up against Venmo, PayPal, or Zelle. Here’s my take:

1. Cash App vs Venmo

Venmo is more social and widely used for friend-to-friend payments. Cash App, on the other hand, offers more in terms of investing and Bitcoin. If you prefer a basic payment tool with fun emojis, Venmo is the way to go. If you’re looking for a multifunctional financial app, Cash App is the better choice.

2. Cash App vs PayPal

PayPal is more business-oriented and operates internationally. It supports invoices and has wider acceptance. However, it can be more complex. Cash App, on the other hand, keeps it simple and is ideal for personal everyday use.

3. Cash App vs Zelle

Zelle is supported by traditional banks and is better suited for bank-to-bank transfers. It does not hold a balance and lacks investment features. Cash App offers more flexibility and does not require a bank account to operate.

Cash App is a great tool for:

- Students needing to split bills or share rent

- Freelancers looking for quick, hassle-free payments

- Individuals interested in investing small amounts

- Those tired of bank transfer delays

- Anyone in need of borrowing money

That’s right. Cash App allows you to lend money whenever needed after unlocking the Borrow option on Cash App by maintaining a good transaction history.

Can You Use Cash App for Business?

Yes, and no. Cash App isn’t officially a business payment processor, but many freelancers and small vendors use it to accept payments. You can switch to a business account within the app, but be aware that there may be fees associated with business transactions.

If you run a formal business, you may find it more beneficial to use Square or PayPal for detailed reporting and tax tools. However, for side gigs and small services, Cash App can work just fine.

These are the ins and outs of Cash App. It’s more than just a money transfer tool—it’s a smart, simple, and fast way to handle everyday financial tasks. Whether you’re splitting bills, shopping online, or making your first $10 investment, Cash App makes it easy and mobile.

I’ve used it for everything from buying coffee to purchasing crypto, and it continues to evolve. If you haven’t tried it yet, I highly recommend giving it a shot.

Just remember to use it responsibly, stay vigilant, and enjoy the convenience it brings to your daily financial life.

Sutton Bank is the primary bank for Cash App cards, while Lincoln Savings Bank handles direct deposits.

How to Get Free Money on Cash App?

Cash App does not offer free money. However, maintaining a good credit and transaction history can unlock the Borrow option on Cash App, allowing you to lend money for a specified period.

Cash App is currently owned by