The Apple Card has been available since August 2019, and I’ve had it for nearly four years now. It was one of the first credit cards I was approved for, mainly because of the titanium material and Apple Wallet integration. Over the years, I’ve used it in various situations and obtained great value from it. However, with the credit card industry becoming more competitive in 2023, how does the Apple Card stack up as a zero annual fee card compared to its competitors? Is it still worth getting?

Apple Card – the surface details

At first glance, as a zero-fee card, the Apple Card falls somewhere in the middle. It offers some good value, but there may be other zero-fee cards worth considering.

The key features include:

- Zero annual fee

- $75 sign-up bonus (as of July 2023)

- No hidden fees – no late fees, foreign transaction fees, or any other fees

- 3% cashback on Apple-related purchases

- 2% cashback on Apple Pay transactions

- 1% cashback on all other purchases

- Daily cashback rewards

- Access to a new Apple Savings account with 4.15% APY

- Cool titanium card

Overall, the Apple Card offers decent value as a zero-fee card. Partnered merchants like Nike, Panera, and T-mobile also offer 3% cashback, adding more value for regular shoppers at these stores.

Other zero-fee cashback cards in the market include Wells Fargo Active Cash Card, Sofi Credit Card, and Chase Freedom, providing various cashback options for consumers to choose from.

Why I believe it’s still worth it in 2023

Disclaimer: This is not financial advice, but rather my personal experience with the Apple Card. While I typically prefer miles and points cards for travel benefits, as a cashback card in the US, the Apple Card stands out.

As a loyal Apple user, I can benefit from the 3% cashback on Apple hardware purchases and the option to finance these purchases interest-free over 12 months, a unique feature not offered by other cards.

2% cashback on Apple Pay

While initially skeptical about the 2% cashback on Apple Pay, the widespread adoption of Apple Pay in the US (85% of merchants) has made this feature more valuable. Online purchases using Apple Pay also qualify for 2% cashback, making it a versatile option for everyday transactions.

Personally, I predominantly use Apple Pay at my grocery store, gas station, mall stores, and coffee shop, reducing my reliance on physical credit cards.

Apple Wallet updates

Given that the Apple Card is an Apple product, it receives regular feature updates with each iOS release. Over time, we’ve seen significant improvements and added features for Apple Card users.

Apple Savings

The Apple Savings account offers 4.15% APY to all Apple Card users, with the option to automatically deposit cashback rewards into this account for additional earnings. While other accounts may offer slightly higher APYs, the seamless Apple integration is a major selling point.

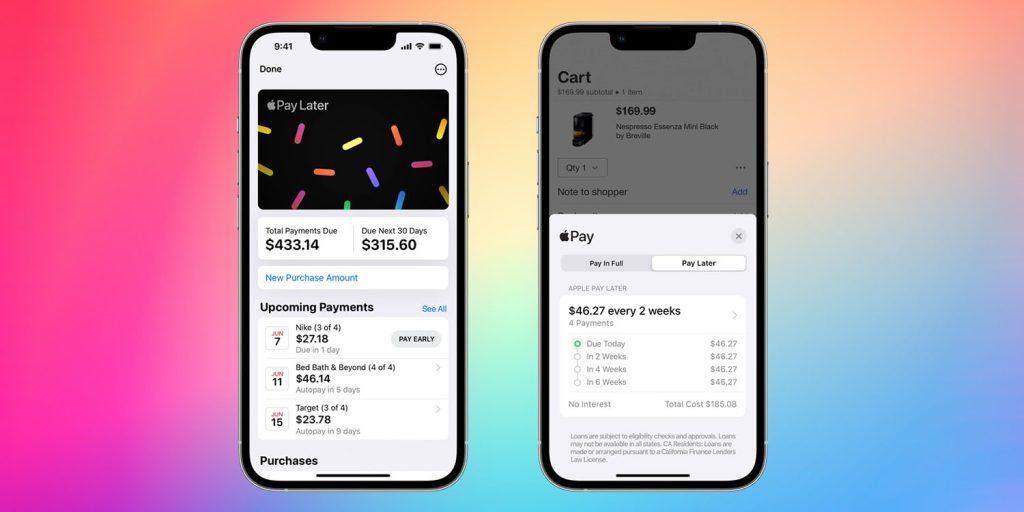

Buy Now, Pay Later

Apple’s Buy Now, Pay Later feature allows users to spread payments for products ranging from $50 to $1000 over several weeks. While convenient for some, it’s essential to manage payments responsibly to avoid interest and credit issues.

Final thoughts

Overall, as a cashback card, the Apple Card remains a solid choice. The expanding Apple Pay ecosystem, ongoing Wallet App enhancements, and unique features like Apple Savings and Buy Now, Pay Later make it a compelling option for consumers in 2023.

Are you a current Apple Card user or considering getting one? Share your thoughts and experiences with the Apple Card in the comments below!

FTC: We use income earning auto affiliate links. More.