In today’s digital era, banking apps have revolutionized the way we manage our finances, providing unparalleled convenience and ease. With a plethora of Fintech apps flooding the market, choosing the right one can be daunting. Whether you’re a first-time account opener or juggling multiple accounts, our guide to the top three iOS banking apps aims to simplify your decision-making process. Having personally explored all three apps, I can attest that each serves its purpose. We will delve into the features, pricing, and customer service of each app, offering you a roadmap to selecting the app that aligns best with your financial needs. Let’s explore these tools that are set to redefine your banking experience.

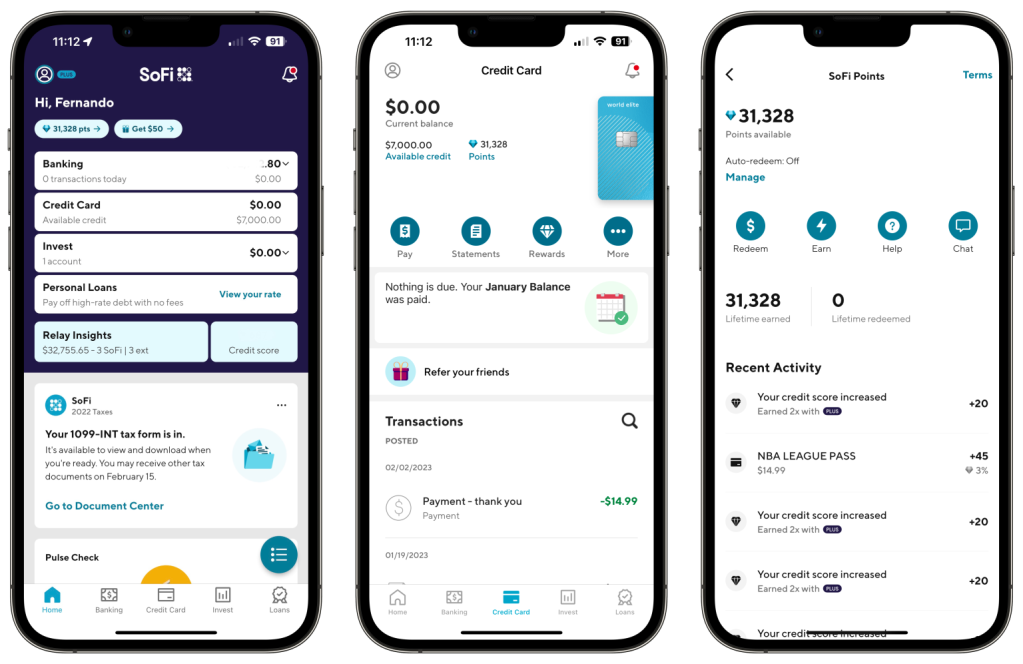

I’ve been a SoFi Bank customer for over two years, and it has significantly transformed my financial management approach. SoFi sets itself apart by offering a wide range of services that cater to nearly every financial planning aspect, all without the burden of traditional banking fees, physical branch visits, and the added benefit of receiving your paycheck two days early.

One of the standout features for me has been SoFi’s diverse range of products. From high-yield savings accounts with an industry-leading 4.6% APY (As of March 2024) to mortgage loans, Roth IRAs, investment options, credit cards, and retirement planning, SoFi caters to almost every financial requirement. Their credit card, in particular, is a favorite of mine, offering 3% cash back on all purchases as a zero-fee card!

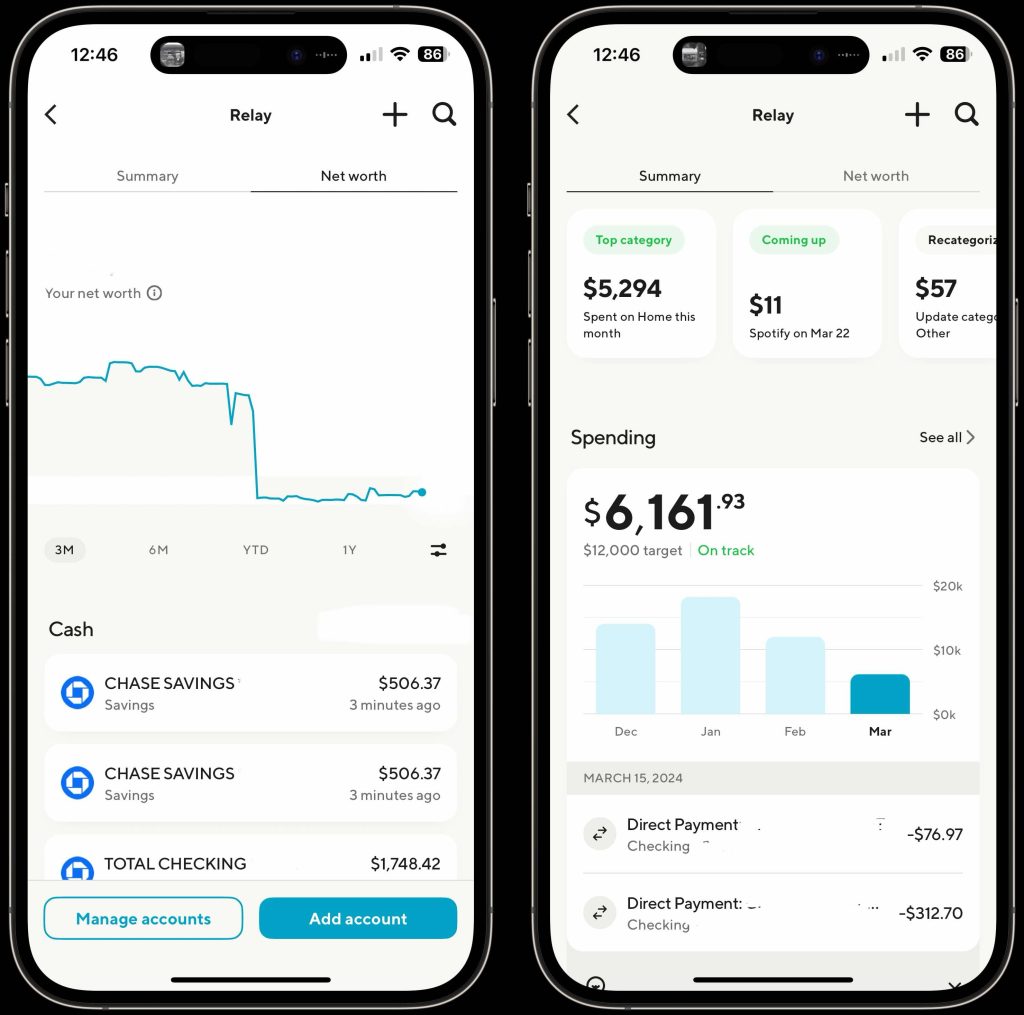

An innovative tool that highlights SoFi’s modern approach is the SoFi Relay. This feature seamlessly integrates your entire financial landscape, allowing you to link external bank accounts with your SoFi accounts. It transforms the app into a central hub for tracking expenses, income, and net worth in real time. This level of financial oversight is invaluable for those seeking full control over their financial well-being.

The user experience of the SoFi app itself reflects the bank’s commitment to modernity and convenience. Its design is not only visually appealing but also functionally superior, ensuring that navigating through your financial data, whether it’s checking balances, tracking investments, or setting savings goals, is seamless and hassle-free. The emphasis on a secure and intuitive user interface, coupled with the comprehensive financial overview provided by SoFi Relay, places SoFi Bank at the forefront of next-generation banking solutions.

Pros

- Feature-rich & easy-to-use interface, rated 4.8 stars on the app store

- High-yield savings account with a 4.6% APY

- Vaults for automatic savings

- No transaction fees, late fees, overdraft fees, or monthly fees

- Early paycheck deposit

- Investment platforms

- Retirement planning services

- Access to a network of 60,000 ATMs

- Mobile check deposit

- Zero-fee beginner credit card with 3% cash back

- $25 incentive for new sign-ups

- Free credit score tracking

Cons

- No physical bank branches

- No cashier checks

- Deposit of cash is possible but not ideal

Who should open a SoFi account?

SoFi is an excellent choice for individuals looking to enhance their financial management. With its user-friendly iPhone app that offers a wide array of services without the complexity, SoFi is ideal for users who prioritize a top-notch mobile banking experience over traditional branches. It provides high-yield savings accounts and access to additional financial products like investing and credit cards, making it the perfect platform for seamlessly integrating banking and financial growth.

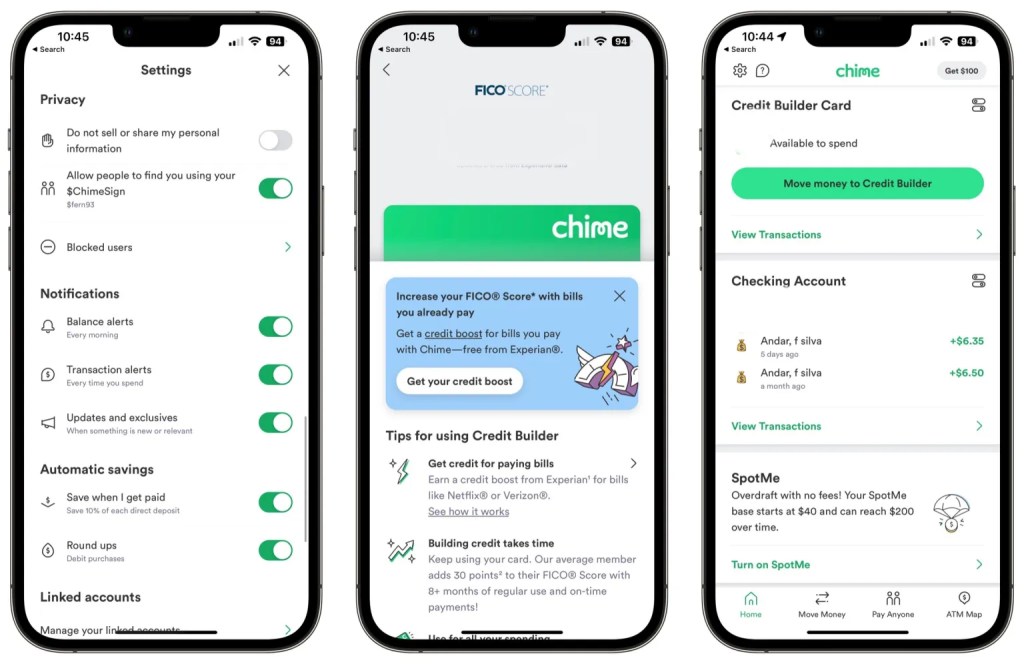

Although I have transitioned from Chime as my primary bank, my time with Chime holds a special place in my financial journey. I was a Chime customer for five years before switching to Sofi. Chime served as a crash course in financial adulthood, teaching me the importance of long-term savings, building a strong credit score, staying on top of bills, and much more.

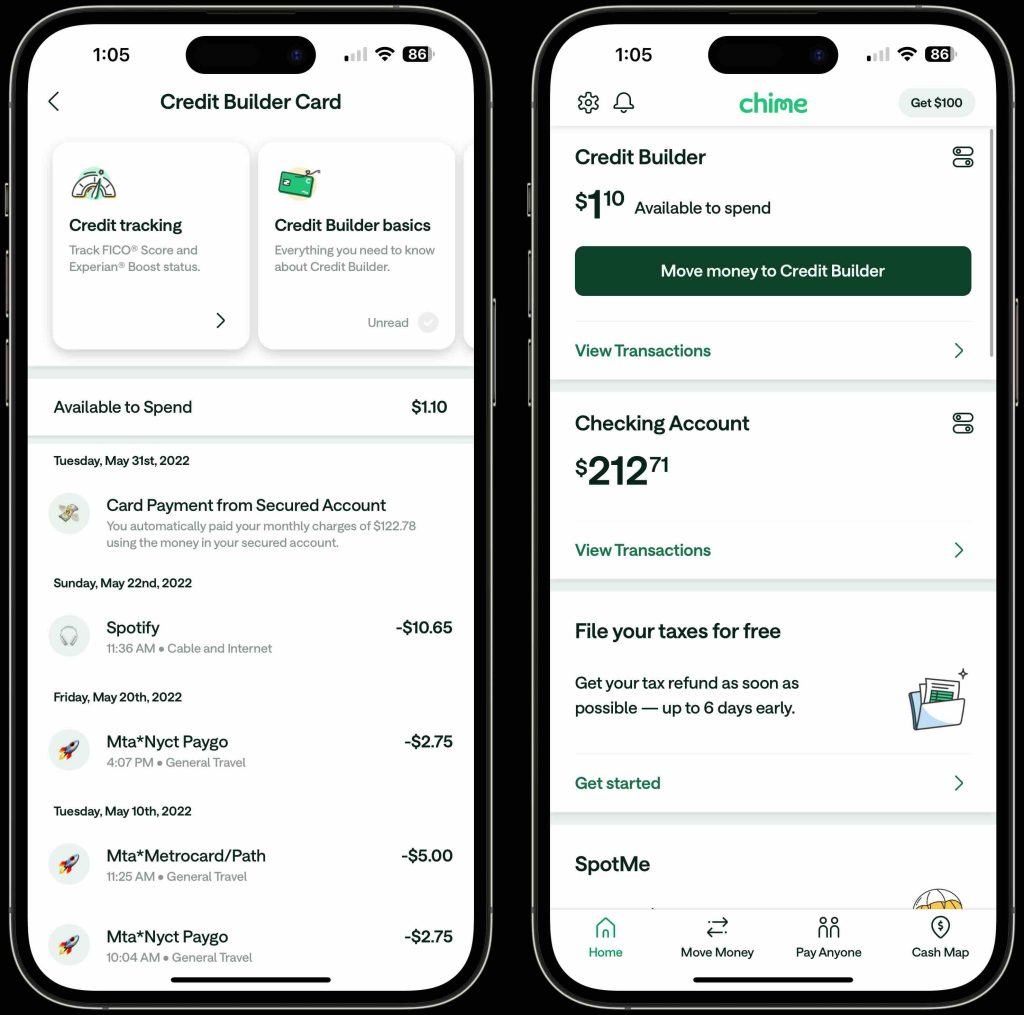

Chime is an excellent choice for beginners. The sign-up process is straightforward, and you can bid farewell to hidden fees. The app is extremely user-friendly, making it easy to keep track of your finances. The real game-changer is Chime’s credit builder card, a smart way to boost your credit without accumulating debt, thanks to a prepaid system that ensures timely payments. This credit builder feature significantly boosted my credit score during the two years I had their Credit Builder card. Plus, with a plethora of free ATMs in their network, you can avoid extra fees.

Pros

- Extremely user-friendly, rated 4.8 stars on the app store

- Chime Credit Builder program – free credit card to help build credit

- Early paycheck deposit

- No transaction fees, late fees, overdraft fees, or monthly fees

- Spot Me service for overdraft protection up to $200

- Automated savings feature

- Lost or stolen card deactivation

- Digital card information viewing

- Mobile check deposit

- Free credit score tracking

Cons

- No physical branches

- Mobile check deposit only available with direct deposit enrollment

- Limited product offerings – no investment platform, loan products, insurance platform, or mortgage offerings

- No cashier checks

Who is Chime for?

I initially joined Chime for its sleek user experience and innovative fee-free banking approach. I sought a reliable mobile-centric banking solution where I could conveniently receive my paycheck. As Chime evolved, I became hooked on their Credit Builder, which substantially boosted my credit score by showcasing my timely payment habits.

Chime is a perfect fit for newcomers to the workforce who seek a banking platform that is easy to navigate, aids in credit building, and simplifies savings without overwhelming complexity. Additionally, they offer a $100 reward for new sign-ups with direct deposit set-up.

Chase Bank is the preferred choice for individuals desiring the reliability of traditional banking coupled with the convenience of a cutting-edge iOS app. It seamlessly merges physical branches with digital innovations, ensuring a seamless banking experience for all clients. The app is a robust tool, providing effortless account management, remote check deposits, and personalized alerts. This digital platform streamlines your financial life, making it effortless to stay on top of your finances with just a few taps.

Moreover, Chase goes beyond digital convenience to offer a comprehensive financial ecosystem. From mortgages and auto loans to student loans, Chase provides a wide array of financial products, making it incredibly convenient to manage all financial affairs in one place.

The icing on