The Significance of Taiwan’s Semiconductor Industry

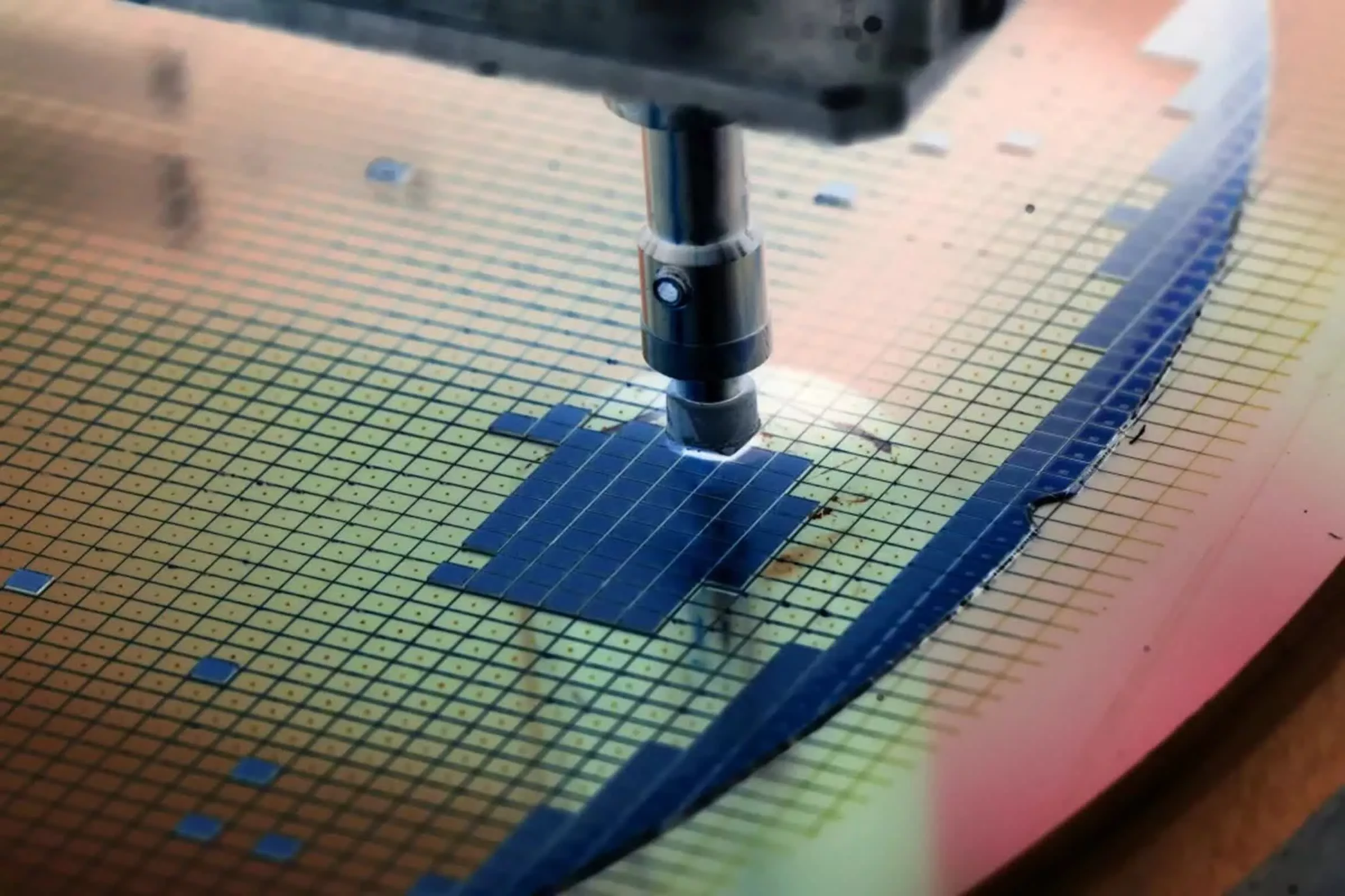

Recently, Taiwan has taken steps to strengthen its hold on advanced semiconductor technology and overseas investments. This move marks a notable shift in how the country manages its critical chip industry. Lawmakers have approved changes to the Industrial Innovation Act, imposing strict controls on the export of cutting-edge process technologies and outbound investments by semiconductor firms, notably TSMC.

Central to these new measures is the “N-1” rule, which prohibits companies from exporting their most advanced semiconductor manufacturing technology. Instead, only technology at least one generation behind what is available domestically can be used in overseas facilities.

Premier Cho Jung-tai has confirmed this policy, which will directly impact TSMC’s expansion plans in the United States and ensure that the company’s latest innovations stay within Taiwan’s borders.

Previously, Taiwan’s regulations did not explicitly limit the export of advanced semiconductor manufacturing processes. The new rules, outlined in Article 22 of the amended Industrial Innovation Act, are set to take effect by the end of 2025.

The government’s objective is clear: to uphold Taiwan’s technological advantage and safeguard national security amid mounting geopolitical tensions and global competition in the semiconductor sector.

TSMC currently stands at the forefront of the industry with its N3P process node. However, the company aims to commence chip production using its next-generation N2 process by the year’s end. Looking to late 2026 and beyond, TSMC envisions two flagship nodes: N2P for client applications and A16 for high-performance computing with advanced power delivery.

Nevertheless, it remains uncertain which nodes will be classified as “flagship” and thus subject to export restrictions. It is also unclear if the government will impose bans on multiple nodes simultaneously when newer technologies are introduced.

The amendments grant authorities the power to reject or rescind overseas investments that jeopardize national security, impede economic development, violate international agreements, or lead to unresolved labor disputes. The law now formalizes these restrictions, elevating them from sub-regulations to statutory law and introducing explicit penalties for non-compliance.

Under the revised rules, companies making unapproved foreign investments could face fines ranging from NT$50,000 to NT$1 million (approximately $30,800). Repeat or serious violations, such as neglecting to address risks to national security or economic development post-approval, may result in fines of up to NT$10 million (about $308,000).

While these penalties carry weight, they are unlikely to dissuade major players like TSMC, which has announced a $165 billion investment in its US operations.

The Ministry of Economic Affairs has indicated that the law’s implementation date will be established after further regulatory adjustments, with enforcement not expected before late 2025.